Streamlining ESG Data.

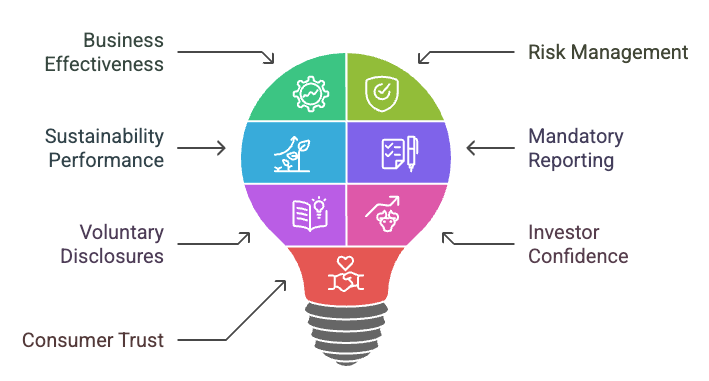

ESG data is no longer just a 'nice to have' for businesses. For leaders in finance, energy, procurement, and facilities, understanding and managing your environmental, social, and governance (ESG) attributes is fundamental to assessing business effectiveness, managing risk, and demonstrating sustainability performance.

It's essential for mandatory reporting requirements like CSRD and SFDR, as well as crucial voluntary disclosures such as GRI and SASB. Growing demands from investors and consumers mean accurate, auditable ESG data is critical for maintaining confidence and reputation.

What is ESG Data?

ESG data provides crucial insights into a company's environmental, social, and governance attributes. It is broken down into three key areas:

- Environmental Data: Covers metrics like resource usage, carbon footprint, climate risks, waste management, and biodiversity.

- Social Data: Includes information on labour practices, diversity and inclusion, community engagement, and customer satisfaction.

- Governance Data: Relates to details such as board structure, executive compensation, business ethics, and regulatory compliance.

This data is vital for assessing business effectiveness, risk exposure, and sustainability performance.

Who Needs ESG Data?

A variety of stakeholders rely on ESG data. Key users include:

- Investors & financial institutions: Utilise it for due diligence, risk mitigation, and making sustainable investment decisions.

- Corporations & business leaders: Leverage it to ensure regulatory compliance, enhance brand reputation, and improve sustainability performance.

- Regulators & government bodies: Need it to enforce regulations and monitor corporate disclosures.

- Insurance companies: Use it to assess climate risks and underwrite sustainable projects.

The ESG Data Headache: Are You Facing These Challenges?

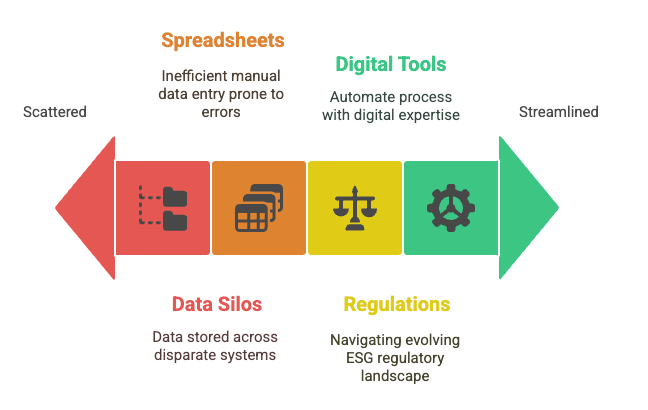

While vital, collecting ESG data often feels like a daunting task. Many businesses grapple with:

- Data Scattered Everywhere: Information is often stored across numerous disparate sources and systems within the organisation.

- Manual Processes and Errors: Relying on spreadsheets and manual data entry is inefficient, prone to errors, and limits real-time insights, potentially skewing results and leading to poor decisions.

- Regulatory Complexity: Navigating the evolving landscape of ESG regulations and reporting frameworks is challenging.

- Supplier Data Woes: Collecting reliable data from across your value chain adds another layer of complexity.

- Resource Constraints: Limited internal expertise and bandwidth can hinder effective data collection.

These hurdles don't just make reporting difficult; they waste resources and make it hard to gain the granular visibility needed to truly understand and improve performance.

Solving the Challenge with a Smart Approach.

The good news? You can transform this challenge into an opportunity for efficiency and leadership.

Streamlining your ESG data collection process is key. Best practice involves:

- Identifying the right data to collect, aligned with key reporting frameworks relevant to your business.

- Establishing a robust governance framework with clear data ownership and processes.

- Engaging stakeholders across departments – including Finance, HR, Operations, and Legal – to ensure understanding and participation.

- Crucially, leveraging digital tools and expertise to automate and manage the process.

How We Help Businesses Streamline.

This is where Bramo Energy comes in. We help businesses like yours implement the best practices and digital solutions needed to overcome ESG data challenges. With Bramo Portal, we enable you to:

- Automate Collection & Minimise Errors: Seamlessly integrate data from multiple sources and automate validation, significantly reducing manual effort and errors.

- Centralise Data: Store all your ESG information in one secure, accessible place for better analysis and decision-making.

- Ensure Compliance: Implement controls and ensure compatibility with mandatory frameworks like CSRD and voluntary standards like GRI, preparing you for assurance and audit requirements.

- Gain Granular Visibility: Get detailed insights into your ESG performance across operations, enabling more frequent and comprehensive reporting.

- Integrate with Existing Systems: Align ESG data strategy with your IT and financial reporting tools for a seamless flow of information.

By providing this streamlined, digital approach, Bramo Energy helps you resolve the core issues of disparate data, manual inefficiency, and regulatory complexity.

Tangible Benefits for Your Role.

Adopting a structured, digital approach to ESG data with company's support translates into real benefits for you and your teams:

- Finance Managers: Strengthen investor confidence through transparent, auditable disclosures and better assess climate and other ESG risks.

- Energy & Facilities Managers: Gain crucial insights into resource usage, carbon footprint, and waste management to drive operational efficiency.

- Procurement Managers: Improve the process of collecting necessary ESG data from your supply chain.

- Directors: Ensure regulatory compliance, enhance corporate reputation, and support informed, strategic decision-making.

Move Beyond the Headache: Get Value from Your ESG Data.

Don't let the complexities of ESG data collection hold your company back!

By embracing a streamlined, digital approach, supported by expert guidance, you can ensure accuracy, efficiency, and compliance, turning a reporting requirement into a driver for sustainability success and business value.

Would you like to know more?

Do you have any questions about one or more of these topics?

Feel free to contact us at hello@bramoenergy.com.