#Procurement

SUMMARY.

In the context of soaring energy prices, which started before the war in Ukraine, we are sharing some of the major developments since 2018 in the energy markets and in the European carbon market with insights from economists.

OIL.

As a reminder, the average price of a barrel of Brent was $71 in 2018 (while it had peaked at more than $100 on an annual average in 2011, 2012 and 2013). The Covid-19 health crisis paralysed the world economy (in particular the transport sector), and caused a collapse in oil prices: the price of a barrel of Brent fell to $18, compared to around $65 at the end of 2019.

With the post-Covid economic recovery, the price of Brent rose to nearly $105/barrel over the first 9 months of 2022:

$/Barrel of Brent

In 2021, oil prices rose to more than $70/bbl on average driven by the economic recovery and OPEC+'s strict supply control policy.

Prices increased at the end of 2021 as a result of the decline in OECD stocks, in particular to compensate for the insufficient supply from OPEC+.

In 2022, the war in Ukraine was certainly a major reason for significant uncertainty about supplies at the start of the year and the lack of investment in exploration-production all over the world has accentuated the phenomenon with insufficient supply and stronger influence of the 23 OPEC+ producers (Saudi Arabia and Russia in the lead) on prices.

In recent news, OPEC+ announced on October the 5th a reduction of 2 million barrels per day (Mb/d) in the production in November 2022 compared to the August levels in 2022. A problem for the United States, which announced "consequences" for this decision favourable to Russia.

According to Reuters, the price of a barrel of Brent could navigate between $75 and $120 in 2023 with two forces at play: the restrictive supply policy led by OPEC+ and a possible drop in global oil demand linked to a decline in global economic growth.

NATURAL GAS.

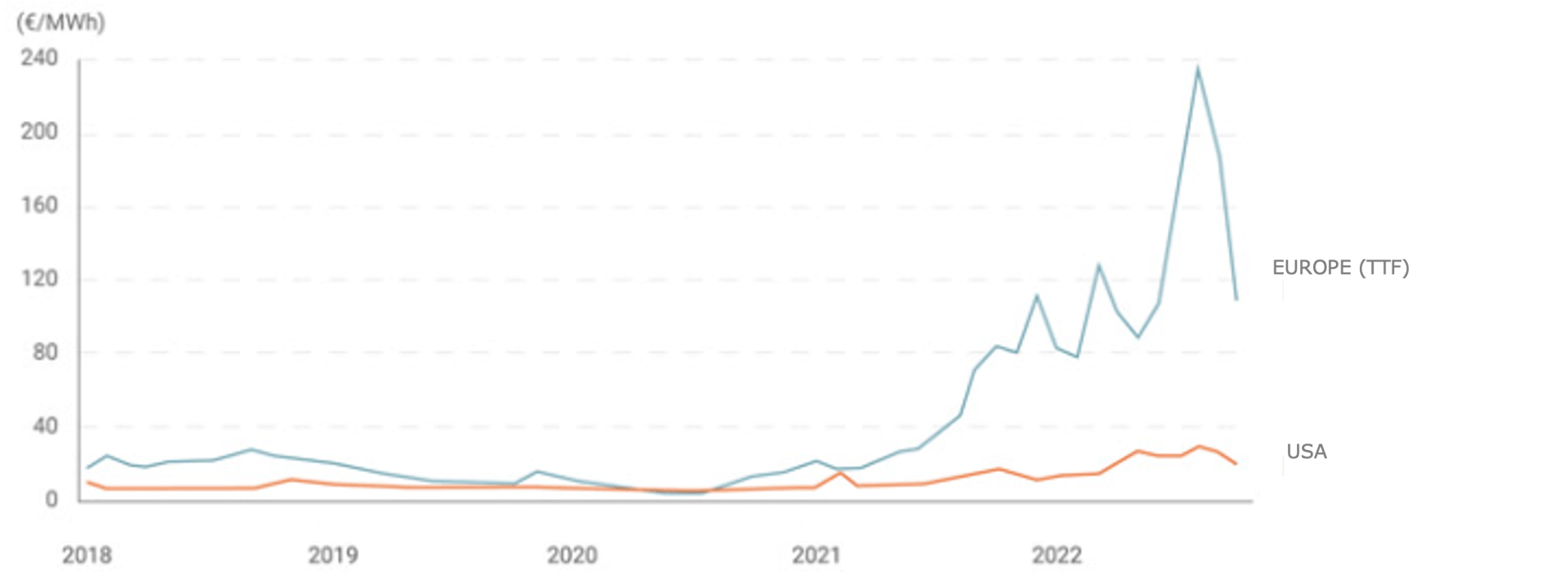

Gas prices in the European market (TTF) are approximately 5 to 10 times higher than the American market. A sharp increase in deliveries of American LNG to Europe could impact economic activity in the United States but also it will retain a margin of competitiveness compared to Europe.

In the European market ("TTF" market place in the Netherlands), it should first be noted that the rise in the price of gas started before the war in Ukraine and it was driven in the 2nd half of 2021 by the economic recovery, particularly in China with already constraints on supply. At the end of 2021, the level of inventories filling was therefore relatively low in Europe.

The start of the war in Ukraine led to many uncertainties, but the gradual stop of Russian imports increased prices which soared in August 2022, with the collapse of Russian deliveries via Nord Stream 1 which were only partially offset by LNG deliveries to Europe.

The price of gas fell sharply in the European market in October 2022 with European announcements on increased supply demand, which was reassuring for the markets. However, prices still remain very volatile, in particular due to availability of American LNG to Europe.

Strong price variations are possible over the coming months; the current trends show that the market is currently anticipating tensions throughout 2023.

COAL.

The price of coal – the world's leading source of electricity, has not soared like gas.

This can be explained by the fact that the coal market is a fairly competitive market with many suppliers and growth prospects are less optimistic for China, which is by far the world's largest importer of coal (China accounted for nearly 52% of global coal consumption in 2021).

Added to this there has been a sharp drop in the cost of maritime freight.

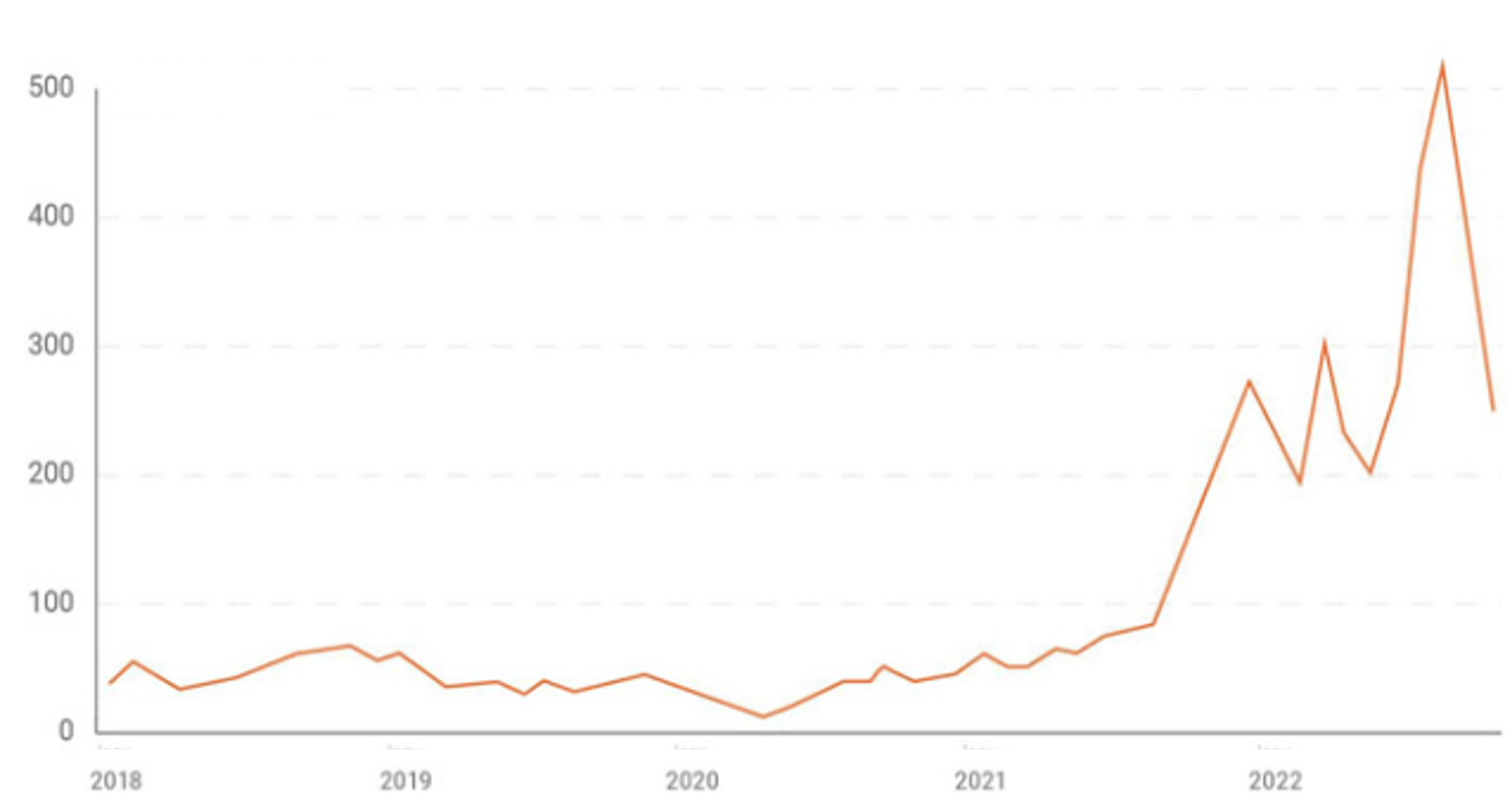

ELECTRICITY.

Electricity prices in Europe largely follow the evolution of gas prices.

This strong correlation is due to the logic used is setting prices based on the last plant generating gas - generally a gas plant during periods of high consumption.

Price volatility is also driven by the uncertain availability of renewable or nuclear production.

€/Mwh in Europe

URANIUM.

The cost of uranium is quite modest in the production cost of nuclear power.

The resumption of nuclear power plant construction projects (56 reactors under construction worldwide, including 18 in China and 8 in India is the main cause of the sharp increase in the price of uranium - a price that was very low until 2020.

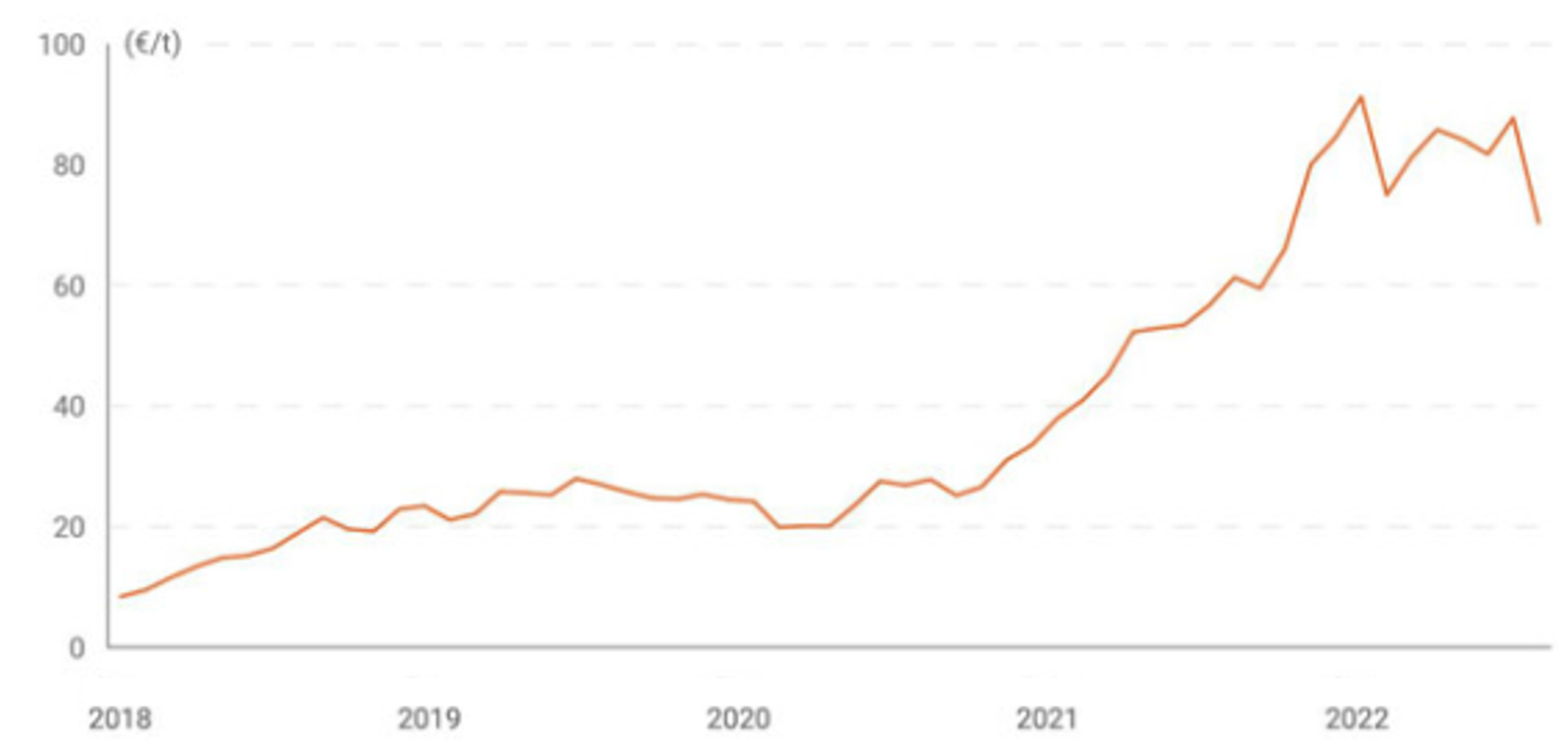

CO2 IN THE EUROPEAN CARBON MARKET.

To understand the surge in price of carbon per tonne of CO2 in 2021, it must first be remembered that this market entered in 2021 with a much more restrictive distribution of CO2 emission certificates. The stability reserve system (implemented in 2019) also makes it possible to temporarily or permanently withdraw certificates to avoid an oversupply on this market.

The rise in the price of gas has also encouraged the use of coal-fired power stations which emit a lot of CO2 and therefore this has led to an increase in the request for more CO2 certificates. The economic recovery and the lack of nuclear production or the availability of renewables have reinforced this increase in the price for a tonne of CO2 .

As an indication, a price per ton of CO2 of €70 increases the cost of electricity production by €28/MWh for gas and by €68/MWh for coal.

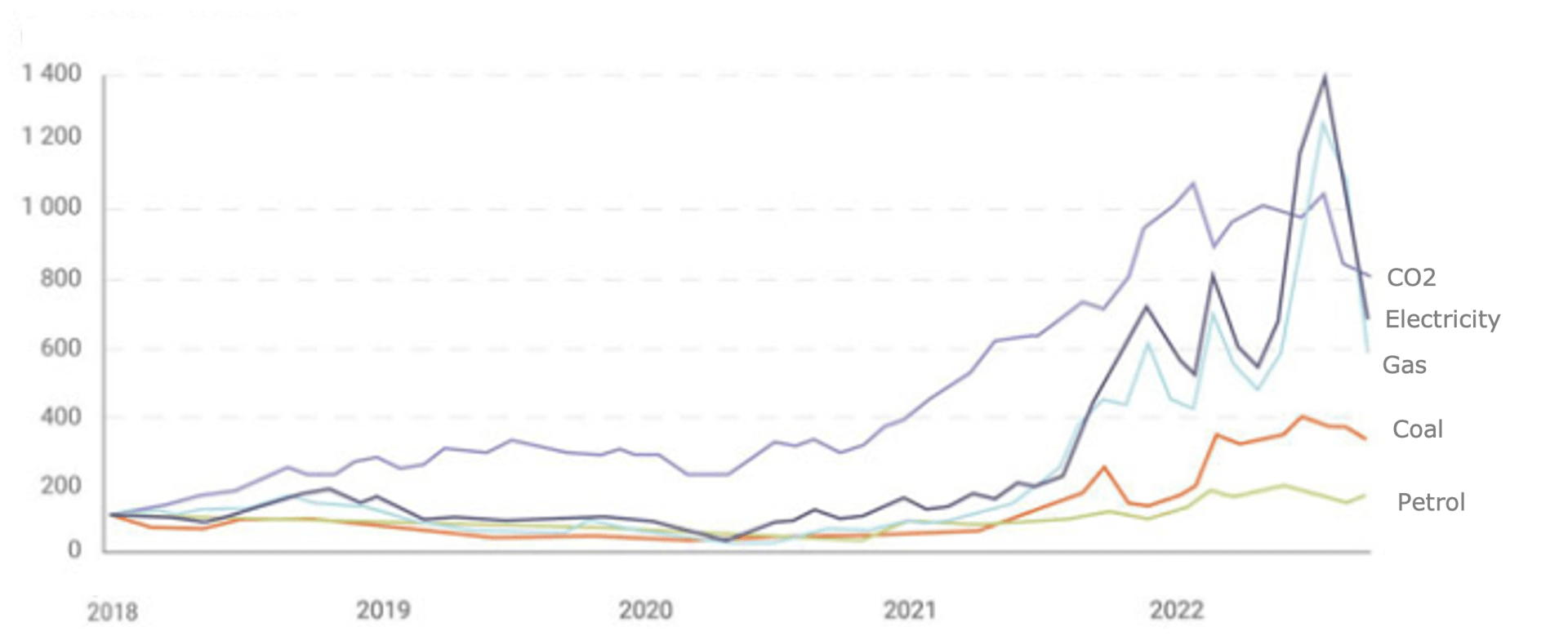

COMPARATIVE GRAPH (evolution with base 100):

Would you like to know more?

Or do you have any questions about one or more of these topics?

Feel free to contact us at hello@bramoenergy.com.